In the survey, you shared hundreds of individual concerns, but one theme kept cropping up in various ways: “I just don’t have enough money!”

I’ve assumed for this article that when people say that, they mean, that they don’t have enough money to pay their bills/debts, save, and do the other things they know they need to do (but correct me if I’m wrong :))

This is something I am very deeply connected with, because I have lived it myself. As you may have heard, my starting salary straight out of college was a mere $30,000 without health insurance or any other benefits. I KNOW what it feels like to be really stretched thin, to be unable to afford much beyond your living expenses, and to WORRY that one thing could throw me over the edge and into massive debt.

(I also know that with massive effort, you can still save, pay down debt, and live a little.)

The Role of Money in Happiness

So, when I received a job offer that would double that salary, I was SURE that it would be the silver bullet to make me feel (finally!) like I had “enough.” I mean, $60,000 was like winning the freaking jackpot to me. I could get my hair cut! I could pay off that nagging credit card debt! I COULD GO TO THE DENTIST!

While earning more did create a lot more financial ease, I confess it still didn’t really feel like “enough.” I still carried around some debt. I still longed to upgrade my wardrobe (which still hasn’t happened). I still wished I could just plan a trip to Paris out of the blue. I still wanted to contribute more to my retirement accounts.

Turns out, even at $60,000 per year, you still have to be patient with paying down your debt, you still have to prioritize what to spend money on, and you still have to save up for the big things you want.

Feeling jaded, I shelved the topic of “financial enoughness” and assumed that I’d need something like $260,000 per year to feel like I finally reached the “Enough” milestone. A quarter million dollars per year seems so ludicrously high to me that certainly, CERTAINLY, you can have your cake and eat it too on a quarter million dollars per year.

UNTIL…

On a trip for work, I started reading the book The Millionaire Next Door by Thomas Stanley. The author shares some research data about the net worth of two doctors making roughly $260,000 per year.

One doctor has a family budget, maxes out their savings and retirement accounts, drives mid-range domestic cars, owned a modest home, and otherwise lived below their means. His net worth was something like $5 million.

The other doctor, also making $260,000 per year had no budget (thinking it unnecessary for his income level), no savings plan, yet lived in a country club neighbourhood, drove exotic cars, replenished the wife and kid’s wardrobes each year, and sent the kids to private school. He had something like a -$100,000 net worth.

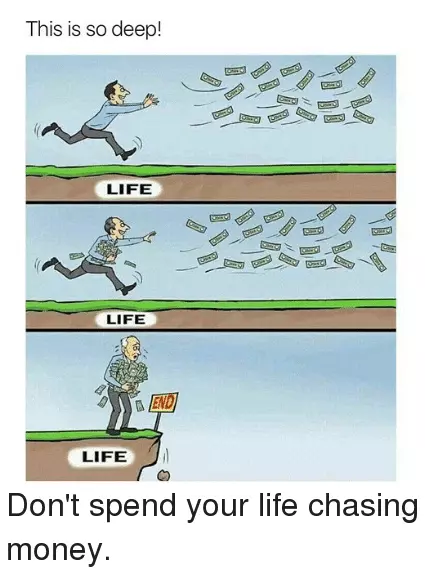

If a guy earning $260K can go through life and STILL have so much debt that he is virtually financially bankrupt, but another guy with the same salary can spin it into millions of dollars–it’s NOT about the income.

So How Much Money is Enough to Make Ends Meet Each Month?

Here’s the somewhat surprising truth: Your income doesn’t decide what amount is enough–it’s how you use the money you have.

So, that means that if you consciously prioritize what’s important, plan how you’ll spend, what you’ll save, and choose to live with less than you can feasibly afford on your salary, you CAN have “enough.” When you PLAN for there to be enough for the things that really matter, voila!, it happens.

Also Read: